What Is Lido Finance, Ethereum's Largest Liquid Staking Project?

Lido Finance has long held the lion’s share of the liquid staking market on Ethereum, but what is it and how does it work?

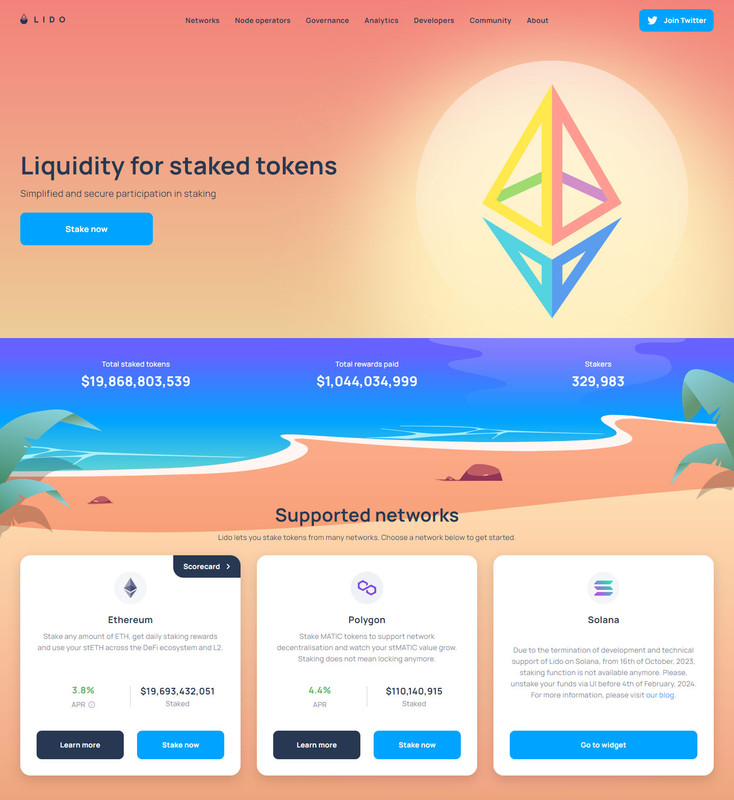

- Lido Finance is one of the largest staking projects in the industry.

- Instead of having to cough up 32 ETH, anyone can start staking with any amount.

- Unlike other stakers, Lido keeps users liquid by offering them a Staked ETH token.

If you’ve been following Ethereum for the last three years, you’ve also likely heard of Lido Finance.

Per an oft-cited Dune dashboard from Hildobby, there are more than 27.8 million–or nearly $50 billion–Ethereum staked total across various cryptocurrency exchanges, individual validators, and decentralized protocols like Lido.

Of that sum, more than 31% is staked with Lido Finance, making it far and away the most popular staking solution on the market.

But what is liquid staking, Lido Finance, and how does it all work?

Keep reading to find out.

What is Lido Finance?

Lido Finance goes hand in hand with Ethereum’s full transition to proof-of-stake.

One of Lido DAO’s business development contributors Marin Tvrdić told Decrypt at ETH CC Paris that when Lido launched, it had a perfect market fit.The video player is currently playing an ad.The massive liquid staking protocol, which launched shortly after Ethereum began its transition to a proof-of-stake blockchain, now commands the lion’s share of the staking market.